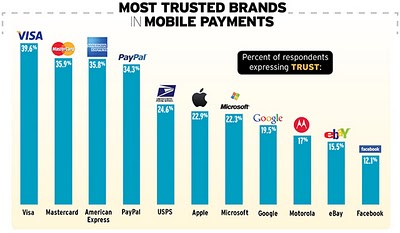

First a bit of a disclosure. Through work, I have a business relationship with Google and previously MasterCard and over the past few years have spent a pretty considerable amount of time working on and thinking about payments. I’m don’t think I am biased but you can be the judge…

This week another consortium was announced to develop a mobile wallet solution. Merchants like Best Buy and Target (among quite a few others) are looking to develop a format and technology that would allow consumer payments within their stores. It’s not clear how this will work or even when it will arrive. Today it’s simply a press announcement.

Previously, we’ve seen quite a bit of press from Isis a joint effort between Verizon, AT&T and T-Mobile. While Isis has gotten some solid press, released their web site and some pseudo demo videos try also have yet to launch. Their proposed launch markets of Austin and Salt Lake City still wait …

While Google Wallet has been live for a year growth appears limited by only being directly offered through Sprint on about half a dozen phones. There’s a lot of opportunity for other carriers though the Isis partnership seems like a pretty clear obstacle until that at least makes it out of the gate.

There are other methods of paying with (tapping) your phone today but they involve the use of a sticker as a proxy for your card and in most cases do not offer any proper interface on the phone to receive back the transaction. An SMS is a start but is pretty lame by today’s standards.

Because the traction on NFC has been slow — and depending on which analyst you ask we are anywhere from 3-5 years from mass adoption — there are some rather interesting bridge solutions ready today that add technology into our traditional card mix. The two that get the most attention are Square and LevelUp. Perhaps PayPal deserves a mention here as well as they are pushing rather hard to break through the virtual barrier into traditional commerce. Though even with theor recent merchant deals it seems like a long road ahead. Both Square and PayPal offer dongles to accept card swipes but also have other methods like phone number (PayPal) or simply your name (Square). LevelUp uses the phone screen to present a QR code much like Starbucks does for it’s own system. While Starbucks an Square announced a recent deal (and investment) one won’t replace the other from what I’ve read instead you will simply have another option in store.

The payment networks and banks are also playing here with wallet tech they hope will be adopted though appears to be a very slow train.

And of course the elephant in the room is Apple. They’ve shown about 80% of a wallet in iOS 6 via Passbook. Like many people I’m hopeful that they will go all the way when the next iPhone shows itself in September. While Apple is likely to light a fire it’s unclear if they will stay proprietary or try to define the industry. It’s likely that we will see some quick arranged marriages following their announcements and the organizing committee is already forming.

The worst possible scenario and frankly the direction a lot of this seems to be heading is that the choices create a stalemate. There are already too many similar potential options and not enough differentiation both between players, but even more importantly from today’s way to pay. Unless an actual problem is solved or benefit added its like the industry is simply talking to itself.